nh bonus tax calculator

Military bonuses are subject to taxation at the time of payment. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent.

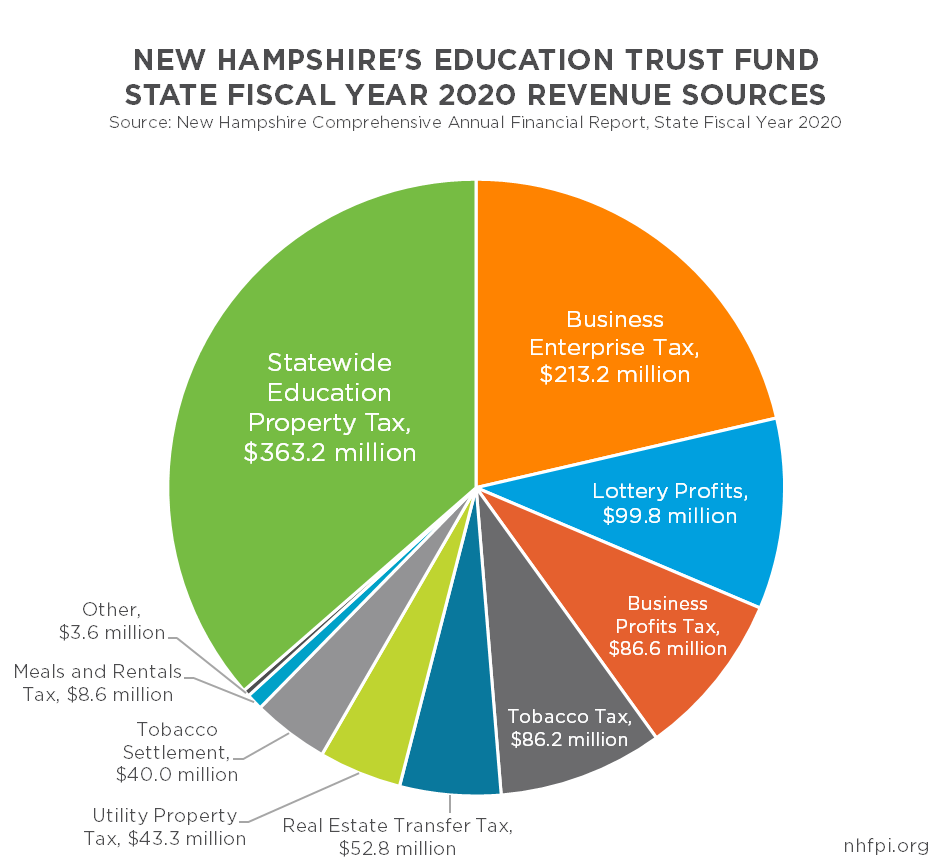

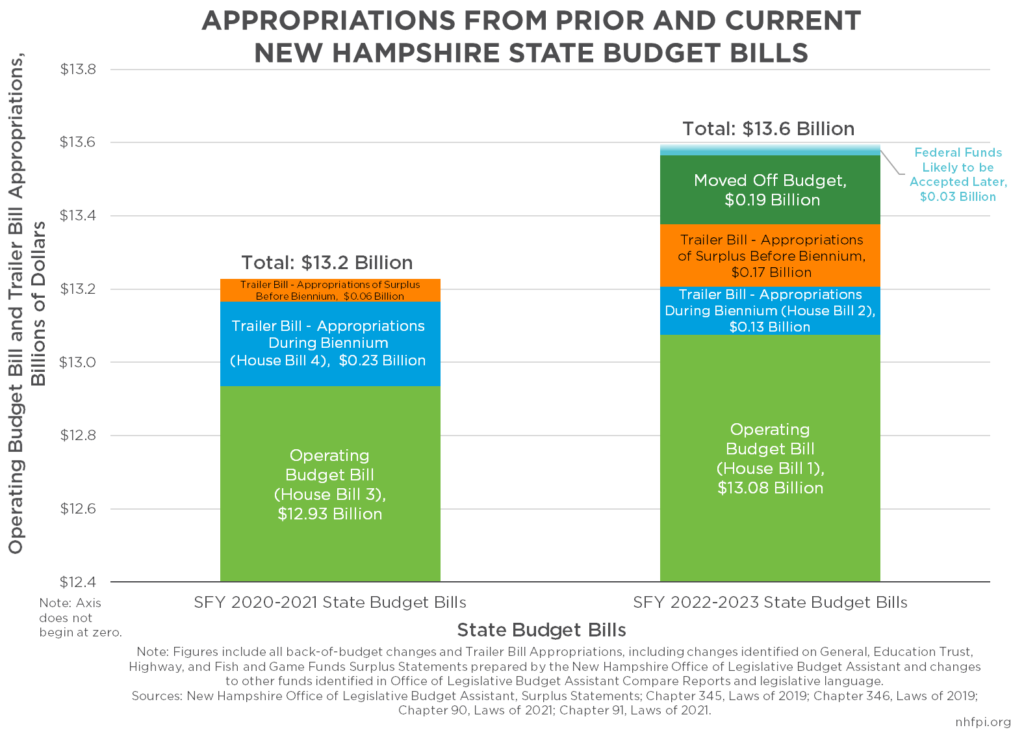

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter.

. In NH transfer tax is split in half by buyer and seller. The results are broken up into three sections. Nh bonus tax calculator Monday February 28 2022 Edit.

For 2021 new hampshire unemployment insurance rates range from 01 to 70 with a taxable wage base of up to 14000 per employee. FICA taxes are Social Security and Medicare taxes and they are withheld from each of your paychecks in order for you to pay into these systems. You will report the bonus as wages on line 1 of Tax Form 1040.

Signing bonus taxes would fall in the above category if received via cash gift. This tax is not paid directly by the consumer. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

State of New Hampshire. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. It is not a substitute for the advice of an accountant or other tax professional.

Recently accepted a new job. Use this calculator to help determine your net take-home pay from a company bonus. However it seems the tax bite out of a bonus check takes more than is left for you.

The 2022 state personal income tax brackets are. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Hampshire local counties cities and special taxation districts. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

This free easy to use payroll calculator will calculate your take home pay. New Hampshire has a 0 statewide sales tax rate and does not allow local. You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code.

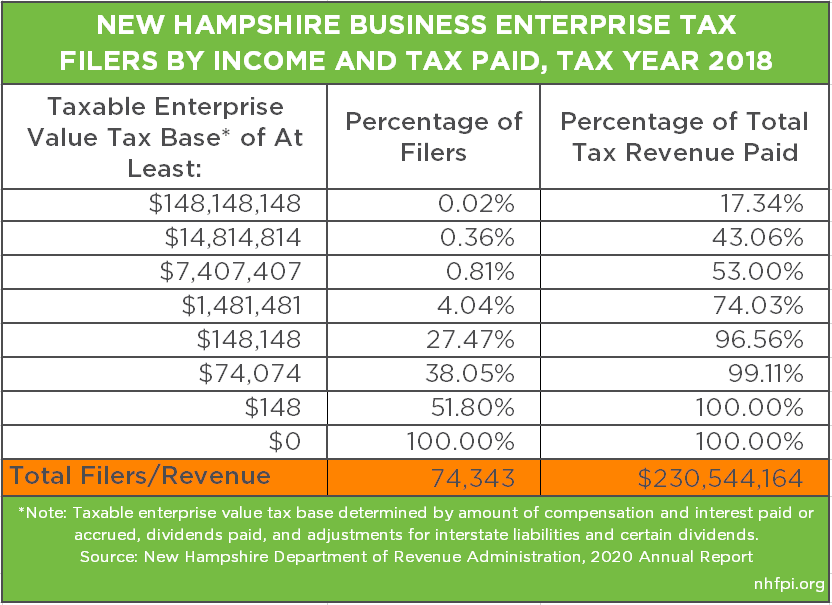

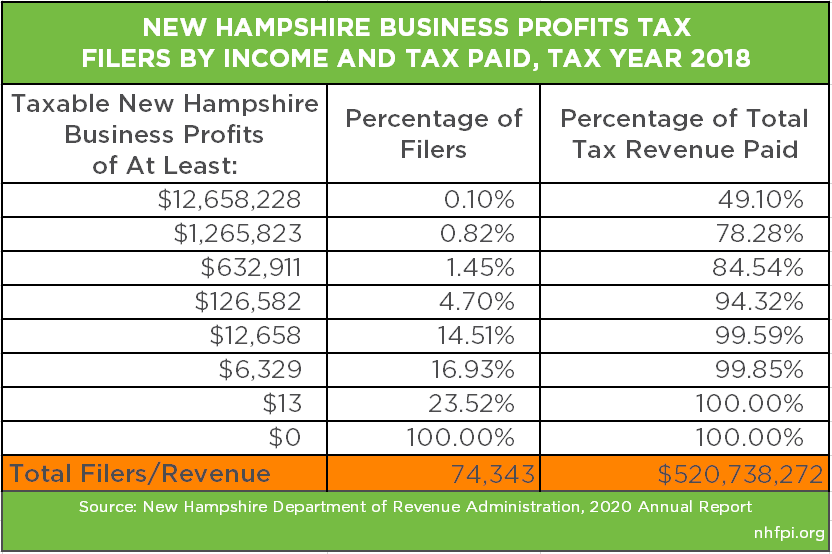

For taxable periods ending before December 31 2016 an 85 tax is assessed on income from conducting business activity within the State of New Hampshire. They may not. What is the Business Profits Tax BPT.

124 for social security tax and 29 for medicare. For multi-state businesses income is apportioned using a weighted sales factor of two and the payroll and property factors. The current Social Security tax rate is 62 percent for employees.

Or use the expertise of a tax pro to help you do so Signing Bonus Tax. One thing youll notice on your New Hampshire paycheck is deductions for FICA Federal Insurance Contributions Act taxes. Before the official 2022 New Hampshire income tax rates are released provisional 2022 tax rates are based on New Hampshires 2021 income tax brackets.

In the case of a non-combat zone military bonus pay or others subject. A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out. Supports hourly salary income and multiple pay frequencies.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Hampshire residents only. Past rules mentioned earlier in this article issued by the Internal Revenue Service required the Defense Accounting And Finance Service DFAS to withhold 25 of that bonus later reduced to 22 on payment. New Hampshires excise tax on cigarettes totals 178 per pack of 20.

New employers should use 27. New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. A cash bonus is treated similarly to wages and is taxed as such.

They should not be relied upon to calculate exact taxes payroll or other financial data. Many employers chose the 25. Home For Sale Near Howard Elementary Tech School House Hunting Home Real Estate Home For Sale Near Howard Elementary Tech School House Hunting Home Real Estate Get 5 Back On Restaurant And Entertainment Purchases In 2021 Federal Credit Union Credit Union Cashback.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. And remember to pay your state unemployment. This information may help you analyze your financial.

The current combined Social Security and Medicare tax rate is 765 percent. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. New hampshires excise tax on cigarettes totals 178 per pack of 20.

Social Security is taxed at 62 and Medicare at 145. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Below are your New Hampshire salary paycheck results.

New Hampshire Bonus Tax Percent Calculator Results. New Hampshire Aggregate Bonus payroll pay NH aggregate bonus payroll calculator pay check payroll tax calculator tax calculators tax calculator take home pay calculator retirement wage calculator payroll services calculator. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any.

Employers have the option on bonus payments of withholding tax at the same rate as your regular paychecks or at a flat 25 percent. NHgov privacy policy accessibility policy. Deductions and personal exemptions are taken into account but some state-specific deductions and tax credit programs may not be accounted for.

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

New Hampshire 529 Plans Learn The Basics Get 30 Free For College

New Hampshire Payroll Tools Tax Rates And Resources Paycheckcity

How Do State And Local Sales Taxes Work Tax Policy Center

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

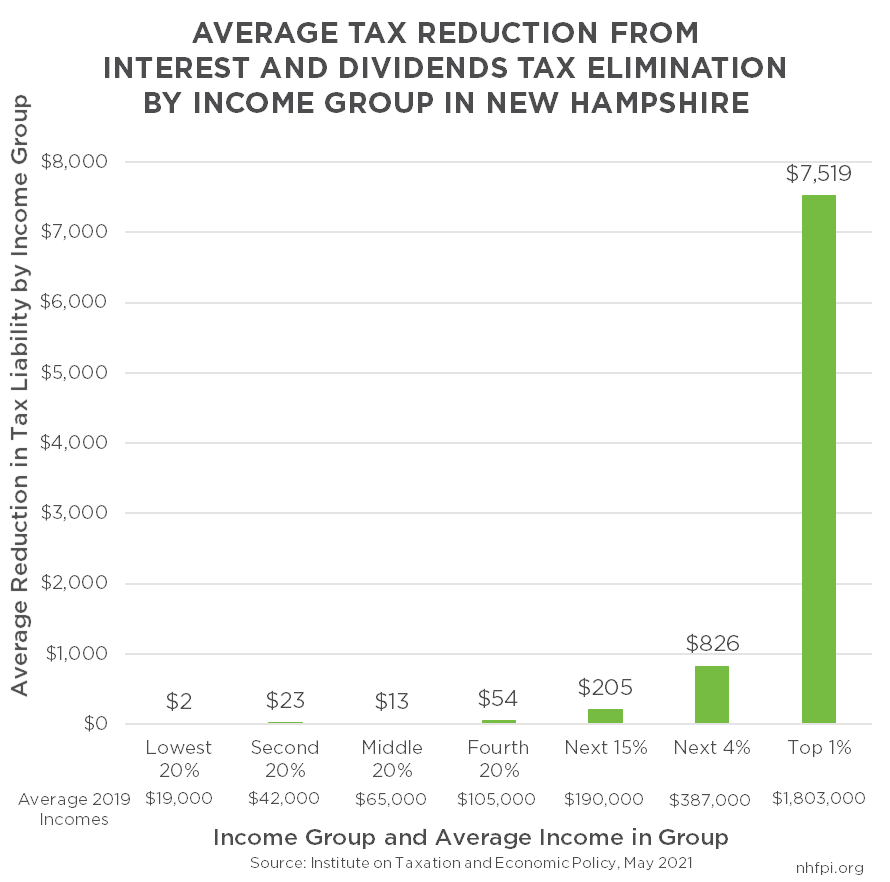

How Do State And Local Individual Income Taxes Work Tax Policy Center

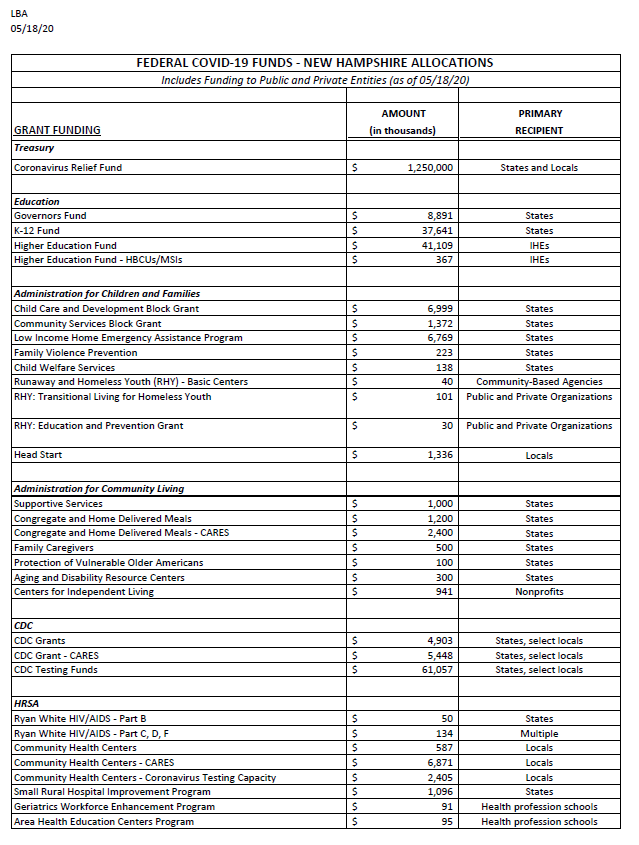

Understanding Federal Funding For Covid 19 New Hampshire Municipal Association

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

How Do State And Local Individual Income Taxes Work Tax Policy Center

Average Salary In New Hampshire 2022 The Complete Guide

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Free New Hampshire Payroll Calculator 2022 Nh Tax Rates Onpay

How Is Tax Liability Calculated Common Tax Questions Answered

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute